To forecast the firm's future sales, manufacturing costs, and other expenses in order to maximise profits while reducing the risk of business losses. Budgeting's ultimate goal is to plan different phases of corporate operations, coordinate the actions of various divisions within the company, and maintain effective management.Ī budget seeks to achieve the following goals in order to reach this goal: Knowing the source and amount of income and the amounts allocated to expense events are as important as when those cash flow events occur. Sticking to a few basic concepts helps to avoid several common pitfalls of budgeting.Ī budget should have a purpose or defined goal that is achieved within a certain time period. Personal budgeting tends to carry a negative connotation among many people. Like money-management software, some spending-management software packages can connect to online bank accounts in order to retrieve a current status report. This method eliminates some of the guesswork associated with forecasting what a person might receive for income when it comes to allocating budgeted money. Unlike typical budgeting that allocates future personal income towards expenses, savings and debt repayment, this type of software utilizes a known amount of money, the cash on hand, to give the user information regarding what is left to spend in the current month. Spending-management software is a variation of money-management software. Some may have a privacy policy governing the use and sharing of supplied financial information.

Several websites have been introduced to help manage personal finances. These programs can categorize past expenses and display monthly reports that are useful for budgeting future months. Products are designed to keep track of individual account information, such as checking, savings or money-market accounts.

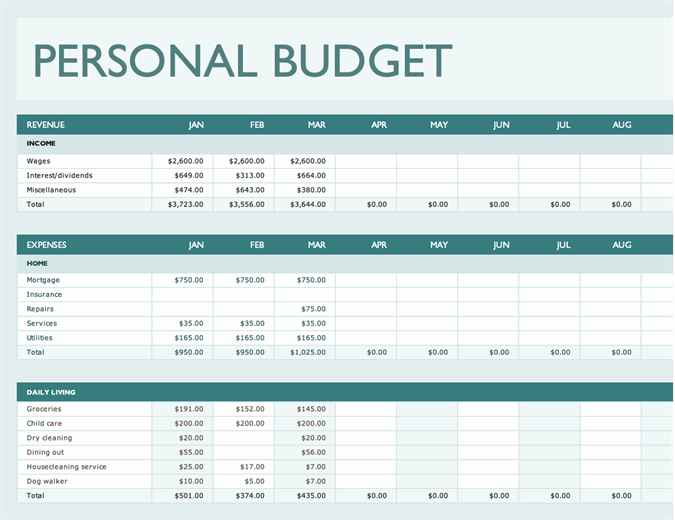

Some software is written specifically for money management. Pencil and Paper Spreadsheet software Money-management software Percentages below are for percent of Net SpendableĪverage annual expenses (2017) per household in the United States are: Sample budget across three years

The following sample illustrates how income might be allocated. 4.1 Spreadsheet budgeting with date-shiftingĪ budget allocates or distributes expected income to expected expenses and intended savings.

0 kommentar(er)

0 kommentar(er)